What would your business do without you?

Why does it matter?

Imagine throwing away what you have spent a lifetime building; but that is precisely what may happen if you do not adequately plan for succession. You need to plan for your exit from the business – whether it is because you retire, or you are faced with serious illness or death.

If you don’t, your business may dissolve, you may lose your assets as well as control, to the wrong person.

If you have business partners, what agreements do you need?

We can help you establish the right agreements needed for your business structure – be they shareholder agreements to address your retirement or business succession agreements that allow for serious trauma, permanent disability or death.

The key is to help you get the balance right:

- Ensure smooth continuity for your business and have clarity amongst partners about who will get management and control.

- Allow for the financial needs of your family, so that they are well-provided for, in your absence.

The heart of the matter

I need to overcome my fear of imagining my business without me in it and more importantly, I need to protect against those who might come out and seek unfair advantage of the situation after I’m gone.

Is yours a family business? Who will get control after you are gone?

A family business may pose its own challenges and requires a structured, formal estate plan. Opinions and emotions can differ greatly within families and your passion for your business may not be shared. If you have a family business, you may need to work through several succession options until all parties agree. For instance, who will manage or control day-to-day business operations; will your children want to be involved and take over the business; are your family members prepared to take on that responsibility; would you want to be in partnership with your business partners spouse or children?

We help you work through all the delicate issues.

Despite operational pressures, your planning needs to start right now

In times of rapid market change, business owners often juggle several roles; time is precious and pressing operational issues take over all other priorities such as long-term planning.

It is crucial to set a plan in motion today.

- Enhance the ultimate value of your business: work through the issues today so you can make any changes in your business structure or processes.

- Seeking specialist advice is crucial so you can design a sound plan for the management, control and ownership of your business.

Case study

Conflict and distress in a partnership

The business suffered the loss of a key partner; there were no agreements in place, there wasn’t enough insurance and the effect on remaining business partners was crippling.

Why is Business Succession Planning Important?

Because it ensures…

Business Succession Planning is for businesses:

- who have a value;

- wanting to plan for voluntary or involuntary exiting; or

- who want to create certainty for the future.

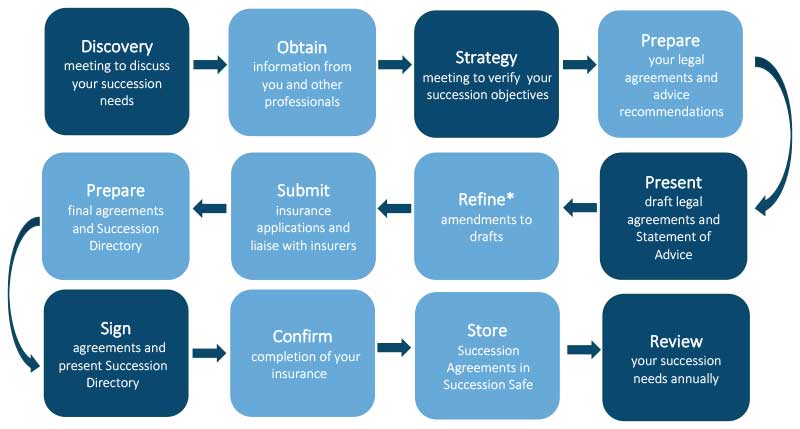

The Business Succession Process

At Succession Matters, our Business Succession Service is all about understanding and implementing what is most important to you and your business.

Working in collaboration with other professionals enables us to develop a plan that will resolve all of your Business Succession needs.

Business Owners’ Insurance

What would happen to your business, if something happened to you?

Why does it matter?

It may be wishful thinking to assume that your business would continue as normal, without you.

The loss of a key person from a business due to serious illness, permanent disablement or death, can put enormous strain on current operations and threaten the future of the business.

Would your business be thrown into crisis without you? How long would it survive?

- How would your business cope with lack of leadership, disruption to operations and potentially reduced earnings?

- How would it deal with nervous creditors; what if the bank calls in your loans?

- Would there be conflict amongst remaining business partners?

- Would there be any predators who may try to gain control of your business assets?

The heart of the matter

If I died tomorrow, would my spouse want to be in business with my partner or vice versa? I don’t want any conflict; I need a clear plan that states who owns and controls the business after I’m gone.

Establish the right business insurance, as part of your succession and estate plan, so that you can provide legal and financial certainty and:

- Maintain business operations, ensure growth and a sound future.

- Meet loan obligations.

- Secure your business assets.

- Provide choices for business partners and your family.

- Minimise potential for conflict and financial stress.

What type of insurance would you need to achieve these goals?

- Specialist advice is vital – there are dozens of policies and insurers to choose from; there are many differences in what protection they give you and how much cover they provide.

- We help you determine your requirements and consider all the options. Your insurance needs may differ, depending on your key role within the business; your business or partnership structures and any tax or other liabilities.

Inadequate business insurance cover may lead to the death of your business

Don’t get caught out – ask us how we can help protect you and your business.

Case study

Conflict and distress in a partnership

No agreements, not enough insurance in place: the effect on remaining business partners can be crippling.

Read more…